The renovation market

Consti is one of Finland’s leading companies focused on renovation contracting and technical building services. Consti offers comprehensive renovation and building technology services and selected new construction services to housing companies, corporations, investors and the public sector. Consti’s services also include service contracts and maintenance. Consti’s operations concentrate to Finland’s growth areas.

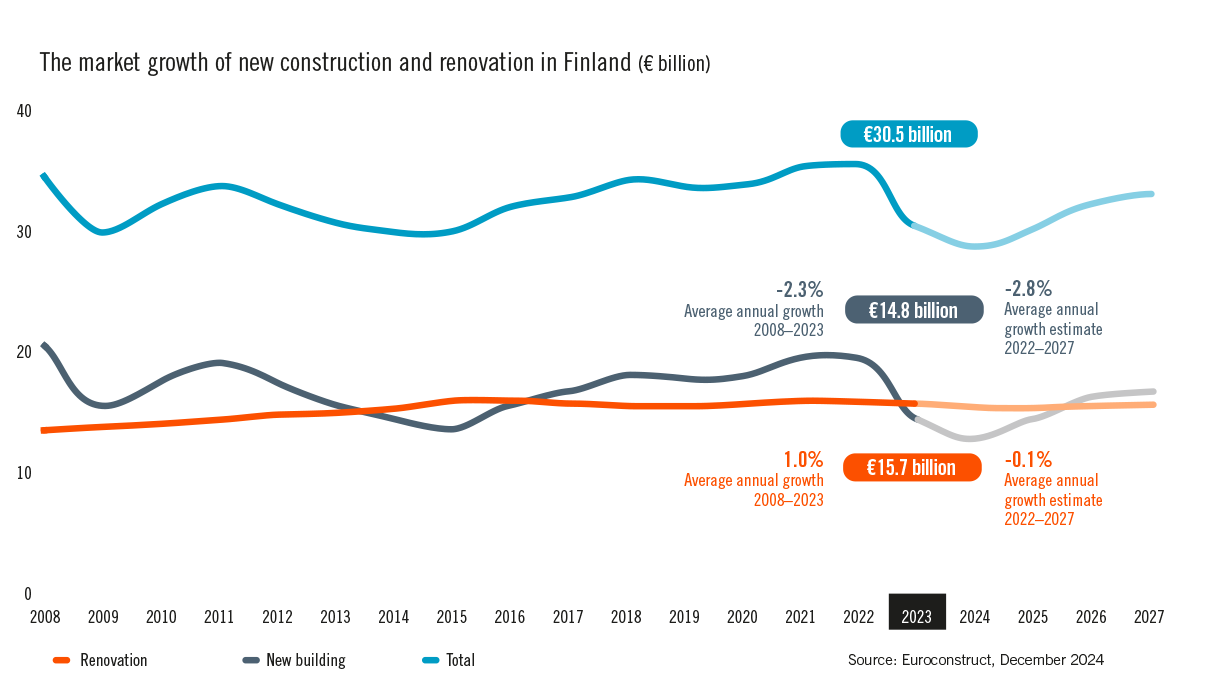

Renovation is needs-based and thus less sensitive to economic cycles than new construction. However, the steady growth of renovation over the past 20 years came to a halt in 2023, and the decline continued in 2024. In its September review, the Confederation of Finnish Construction Industries RT estimated that the development of renovation in 2024 was -4 percent. Euroconstruct's estimate, published in December, is -0.9 percent.

In 2024, building construction continued to decline, but the decrease levelled off from the previous year. According to Euroconstruct's estimate, total housebuilding construction output, including both new construction and renovation, shrank by about 6 percent in 2024 compared to the previous year. The sharp decline in building construction is primarily due to the halt in new housing production after an exceptionally intense period of housing construction. Residential new construction decreased by approximately 30 percent for the second consecutive year. In other building construction, the changes have been far less significant.

The sharp drop in new construction has meant that more money is currently being spent on renovating existing homes than on building new ones. At the same time, competition for renovation projects and building technology contracts has intensified significantly. In 2024, the value of residential building renovations remained almost on level with 2023, i.e. around nine billion euros. The value of other renovations was about six billion euros.

Nearly two-thirds of renovation work is focused on residential buildings, and more than half of this is estimated to be professional renovation. In residential renovations, building technology plays a key role, accounting for about 35 percent of the value of renovations. In non-residential buildings, in addition to technical age-related repairs, renovations include a great deal of building purpose modifications, such as converting old, underutilized office buildings into hotels or apartments, or improving them to better meet current needs.

New construction of non-residential buildings remained roughly on level with 2023 in 2024. Growth has been driven by large hospital and school projects. Office construction has also continued in the Helsinki metropolitan area. Industrial construction, on the other hand, decreased. Several planned energy-related projects are expected to boost industrial construction in the coming years.

About one-fifth of all renovation is maintenance and upkeep, with a higher-than-average share in non-residential buildings.

Residential renovation is estimated to have remained almost at the previous year's level in 2024. Euroconstruct's estimate is a -0.4 percent change from 2023, and the same message is conveyed by the Renovation Barometer published by the Finnish Real Estate Federation in November. The outlook for housing companies improved, especially at the end of the year 2024, due to a clear decline in interest rates.

According to the Finnish Real Estate Federation's Renovation Barometer, water and sewer systems remain the top renovation priority for apartment buildings. The next most common renovations are roof and facade repairs, as well as heating system modernisations. The rising cost of district heating in many cities is a key factor driving heating system upgrades.

Renovations of commercial and office spaces have also been postponed due to the rapid rise in costs. In addition, the oversupply of commercial spaces and the decline in property prices have slowed down repairs. As the economic situation improves, the oversupply is expected to encourage property owners to improve the competitiveness and rentability of their spaces.

Both total housebuilding construction and renovation are expected to return to a growth trajectory in 2025. Euroconstruct's forecast for housebuilding construction growth in 2025 is 5.3 percent. Following a weak comparison year, new housing construction is expected to grow by about 26 percent. Non-residential construction is expected to grow by about 2 percent.

The renovation market is projected to return to moderate growth. Euroconstruct's growth forecast is 0.3 percent, while RT's is 1.0 percent. The anticipated growth is primarily driven by residential building renovations.

The market situation in Finland and drivers affecting the industry

Renovation has been reduced partly by the same reasons as new construction, such as rising interest rates, inflation, and repair costs, as well as increased maintenance costs for properties, such as the rising cost of heating.

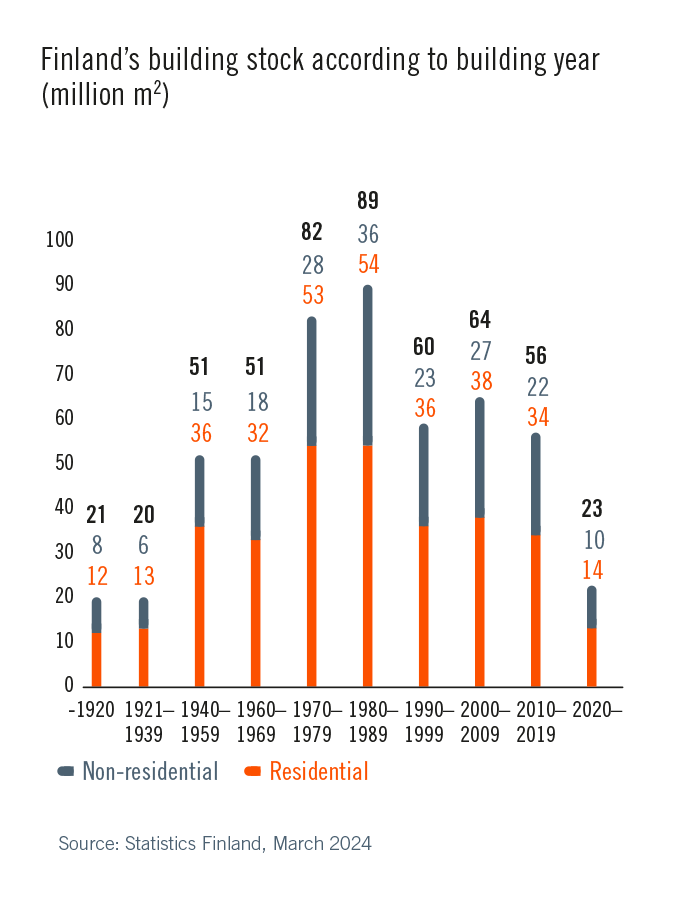

The demand for renovation is supported by the large number of residential buildings that are reaching the age for pipeline renovations. Properties built in the 1970s, which have the largest amount of residential floor space, are now in need of renovation. Additionally, many properties from the 1980s, a significant portion of which are row houses, are also reaching renovation age, with 1980s apartments representing the largest share in terms of quantity

In addition to building technology renovations, many housing companies have an increasing need for facade repairs, which have often been overshadowed by pipeline renovations for financial reasons. The importance of facade repairs and maintenance continues to grow as winters become increasingly wet. Alongside technical repair needs, expectations for living comfort have risen. The repair needs of commercial spaces are also driven by changing space requirements.

The EU's Energy Efficiency Directive, which came into force in May 2024, is driving the need for energy renovations. The directive aims to reduce the energy consumption and greenhouse gas emissions of buildings. In commercial properties, the demand for energy renovations is also influenced by user requirements – including both financial considerations and environmental certification standards. The need for energy renovations applies to both residential housing companies and various commercial spaces.

Overall, the need for renovation is maintained by both the aging building stock and societal changes such as urbanisation, population aging, changes in working methods and retail, and sustainability goals. Renovation plays a central role in reducing the carbon footprint of the built environment, as the number of new buildings grows by only about one percent per year.

In Finland, both new construction and renovation are strongly concentrated in growth centres.

Competitive landscape

The renovation market in Finland is very fragmented. Major construction companies have typically focused more on the new construction market, where the average project is substantially larger than in renovation. The renovation market has been served by numerous small operators, often focusing on one particular segment of the renovation market.

In 2023 Consti was the largest renovator in Finland when measured by revenue from renovation, according to construction industry journal Rakennuslehti report published in June 2024. Consti also differentiates itself from its competition with a comprehensive service offering ranging from servicing work and small contracts to multi-year contracts worth millions of euros